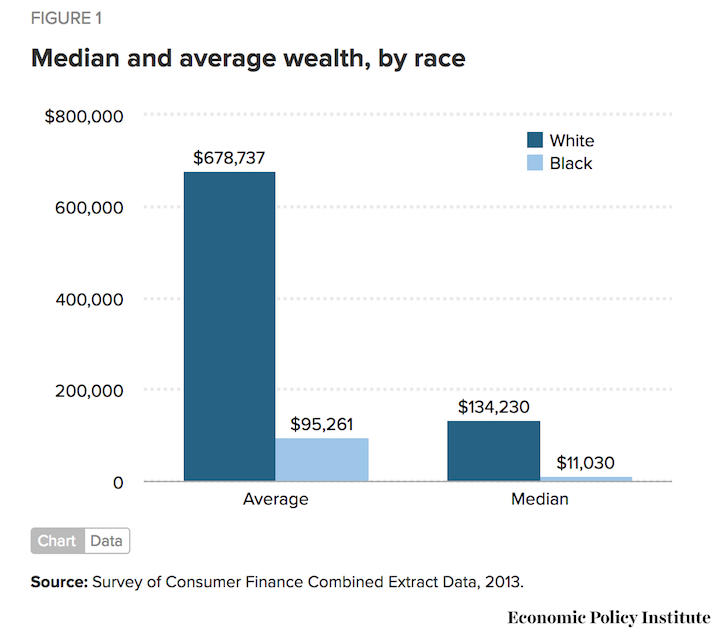

If any of these numbers surprise you, you’re not alone. Why we know so little about wealth and why it matters The top 10 percent of the wealthiest households own nearly 90 percent of the stocks in America, while those in the bottom 90 percent own a little more than half of all the real estate in America. One reason is that the rich tend to store their wealth in businesses and stocks, and those in the middle class store theirs in housing. Why are the wealthy so much wealthier than everyone else? The issue has come up in the presidential race, with Democratic candidates advocating policies like homeownership assistance in formerly redlined neighborhoods and government-run savings accounts given to every child at birth. These gaps are nothing new, of course, yet many A mericans aren’t aware of them. This pattern persists for wealthier black families: A family at the 90th percentile of black wealth has about the same wealth as a family in the 65th percentile of white wealth. This means that the typical black family is as wealthy as a white family at the 20th percentile. That is, how would the wealth rank of families change if you compare them across race? They found that a black family in the 50th percentile of wealth has a rank gap of negative 30 points. Steins make use of an interesting concept known as the rank gap. The economists Moritz Kuhn, Moritz Schularick and Ulrike I. As of 2016, the gap between the median black family and the white family has grown to $154,000, up from $133,000 in 2013. The typical white family has 10 times as much wealth as the typical black family, and eight times the wealth of a typical Hispanic family. The wealth gap between white and black Americans is stark. Households in retirement age have a much higher wealth to income ratio, but that’s because many are working less than they were in their prime working years. But most households in late middle age have three times their incomes saved.

For instance, most households today don’t have twice their incomes saved by age 35. But how much does being a millionaire mean today?Īcross different age groups, these ratios vary widely. What is rich when it comes to wealth? In the past, “millionaire” was synonymous with being rich. One million isn’t quite what it used to be.

The median household has a modest $97,000 in wealth, while households at the very bottom are actually in debt. Maybe this is what it means to actually feel rich, even if your income is small and your life is not fancy.Ī lot of families can’t afford that feeling. And wealth in the form of a home serves as shelter as well as a hedge against rising rents. It can enable you to start a business, pay for an education or put a down payment on a house. It can smooth over financial setbacks like a period of unemployment, an expensive car repair or unforeseen medical bills. Housing costs and other living expenses can vary widely by area.īut wealth generally buys security. Wealth can have its flaws, too, as a measuring stick. Can you really feel rich if your income, however large, barely covers your expenses? Perhaps wealth (the net total of all your assets minus your liabilities) is a better measure. When we looked at income ranks recently, many people were surprised (and some annoyed) that our calculator told them they were “rich.” Even though their incomes were high, many argued that after paying their mortgage, student loans and child care and other expenses, they had little left over.

0 kommentar(er)

0 kommentar(er)